Resources

Resources for USDA Rural Development Home Loans

The USDA Rural Development Single Family Housing Guaranteed Home Loan Program is a low interest, fixed-rate, no down payment home ownership loan for qualified applicants who want to purchase a home or refinance their current Rural Development Loan in an eligible USDA Rural Development area.

The loan is offered through a private financial institution and guaranteed by USDA Rural Development, and it does not require a down payment.

Eligibility for these loans are based on two things: household family income and where the property is located.

How do I verify the most up to date household family income limits for my county when using a USDA loan?

Income eligibility for a USDA Rural Development loan varies according to the average median income for each area.

Visit the USDA's interactive income eligibility website to determine if you are eligible, or see this PDF to check income limits in a county by county format.

Where are eligible USDA Rural Development Areas?

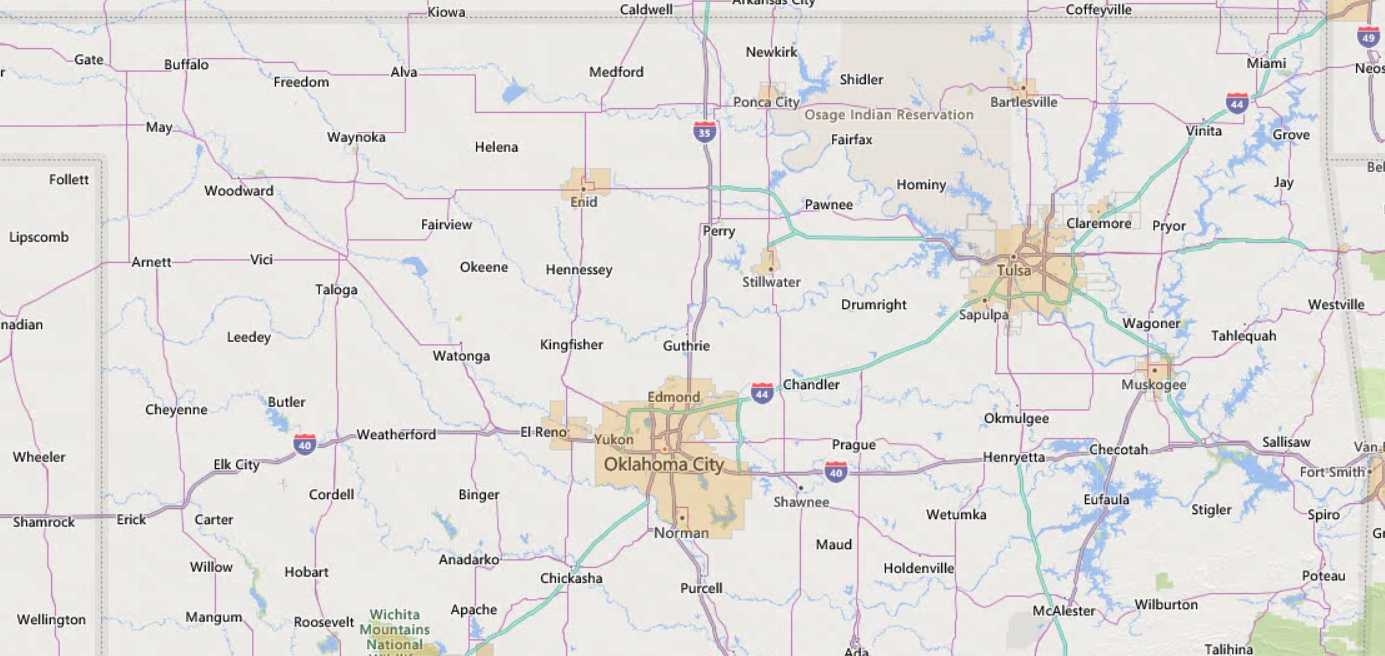

Most USDA Rural Development eligible houses are located in neighborhoods or on small parcels of land. The USDA publishes a detailed map to help you determine if a property is eligible for a USDA Rural Development loan.

Check to see if your property is eligible on the USDA website.

In the map below, ineligible areas in Oklahoma are highlighted in yellow. (Map updated September, 2021.)